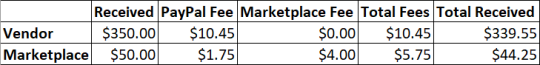

A marketplace fees example

We get asked a lot about how fees work on Marketplaces Inc. As a marketplace operator, you will set the percentage of sales commission that you charge per transaction. This also reflects in the % of fees that you will pay to the payment gateway (PayPal).

In PayPal, the fees that they charge are split proportionally by the amount of money that each entity receives in the transaction. The amount of fees PayPal charges can vary in the operating country of the marketplace.

This diagram shows a good example of how the fees are split by PayPal.

We have created a test sale through our demonstration marketplace to show this in action.

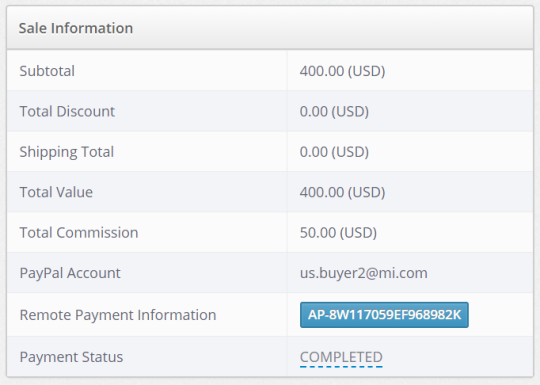

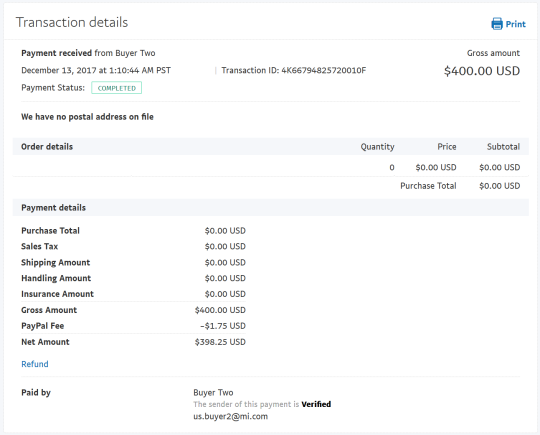

First we have the marketplace sale summary for an item sold for $400, with a 15% sales commission set by the marketplace.

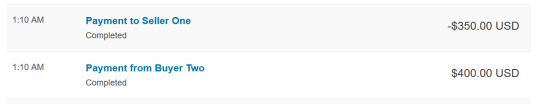

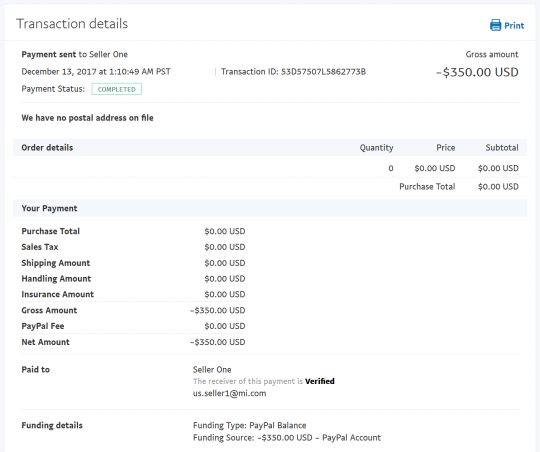

Next we can see this money being received into the Marketplace operator’s PayPal account and immediately funds being forwarded onto the vendor’s account.

If we look at the details of the money retained by the marketplace operator, we see that a fee of $1.75 was paid on this.

If we look at the detail of the payment that was sent to the vendor we see that no fee was charged at this point to the marketplace operator.

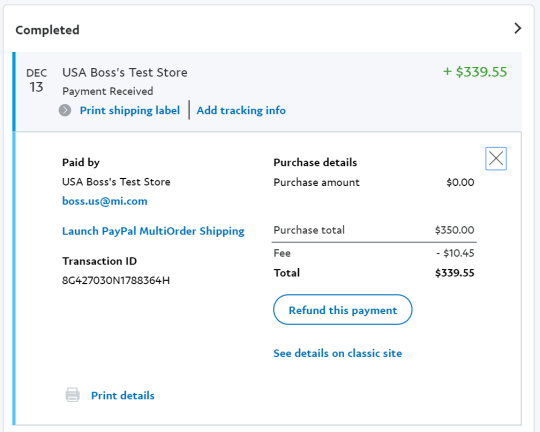

Now when we explore the vendor’s PayPal account we can see the receipt of this payment from the marketplace operator, with a fee of $10.45 being charged.

Lastly, depending on your marketplace subscription plan, Marketplaces Inc charges a transaction fee that is invoiced for at a later date. On our most popular plan, the Premium plan, a 1% fee is levied on all sales. So on a $400 sale, a $4.00 transaction fee will be invoiced for.

Let’s look at a summary of that in table form